Do you experience Cash Flow Pressures, Losses,

or Underperformance because:

You're a small company

And with your current mindset, likely to stay that way

Convincing yourself that the big profits aren’t for you

Spinning you in a vicious circle that’s disrupting your perspective

You realize that 50% of your marketing spend works:

But just not sure which 50%.

Therefore throwing money at strategies that don’t deserve it

And depriving strategies that need more

You have too much money on the line:

Relying on a hope and a prayer

Depending on guesswork In the era of big data accuracy

Slowing business to a snail’s pace when it should be going gangbusters

Too many shockers have hit you out of left field:

Demonstrating that emotions are driving you, not KPI logic

Creating insecurity in the nation’s most secure asset class

Leaving you gunshy even when great investments are available

You can’t respond to peer questions

Making savvy discussion an impossibility

Losing good connections hand over fist

Looking amateurish in a professional arena

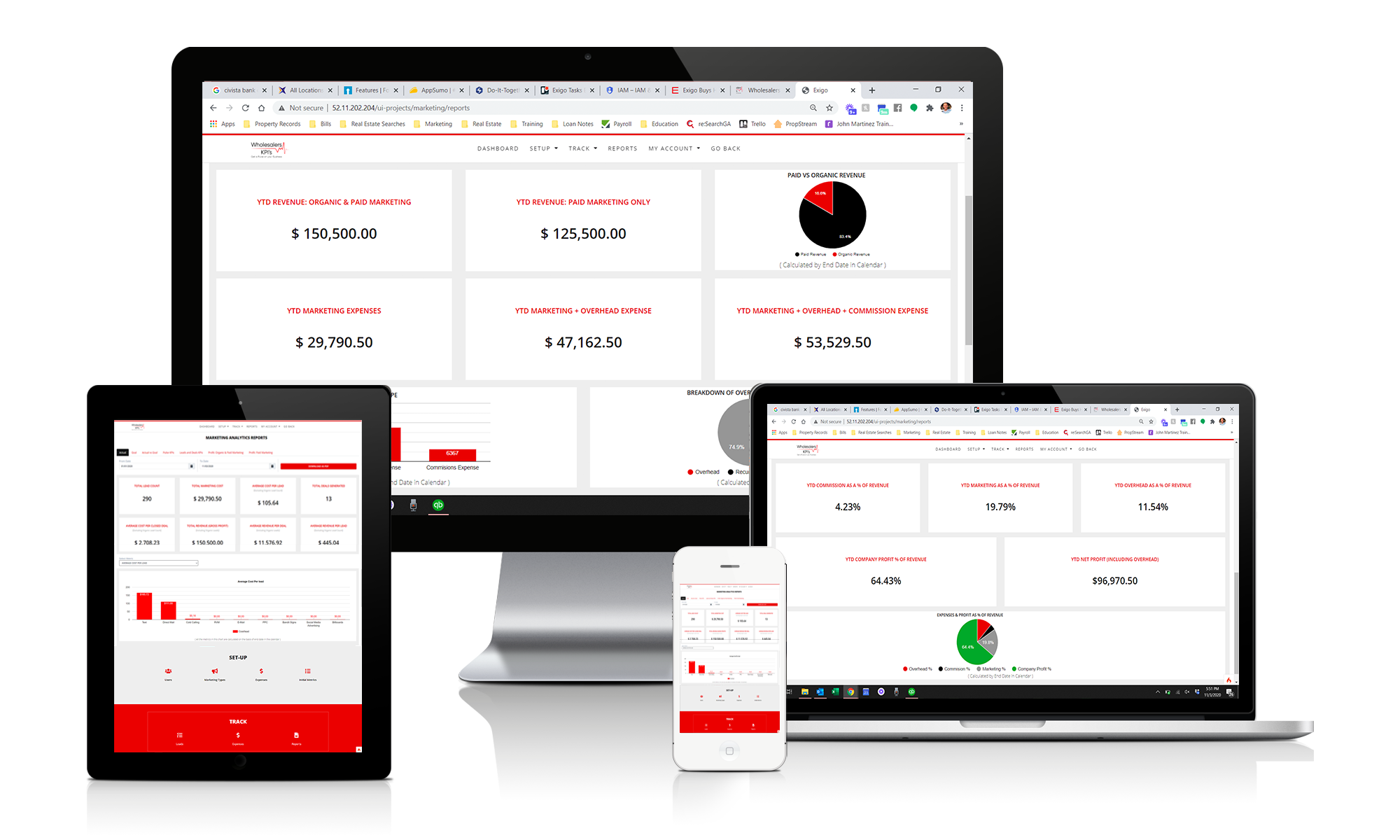

Here are some staggering examples of our expert approach

and why it makes all the difference

AVERAGE PROFIT PER DEAL

$11,415.09

Most wholesalers obsess over revenue. We focus on the average profit per deal. Who cares what the revenue is if what comes beneath it doesn't make any sense.

COST PER LEAD

$14.69

Many real estate marketers get frantic when it comes to generating leads. That's all good and dandy until you see how much money you're spending to secure that lead in real-time. A big KPI is the cost per lead.

COST PER CLOSED DEAL

$734.50

So you're happy that you converted four leads into sales. What did that take out of the bank balance? The cost per closed deal shows the initial expense for generating the prospect + the overhead to convert them into a customer. You may be shocked when you see you need five closings to break even.